Year of Assessment Year of Assessment Deduction is Allowable Amount of Interest Deductible RM When the Interest Deduction can be Claimed 2014 2014 35000 From 3152024 2015 - 2023 2015 2023 60000 each year From 3152024 2024 2024 25000 From 3152024. Given 3 Kena Tax Sdn Bhd never pay PCB on the accrued director fee.

6 6 Financial Reporting Liquidation Basis Of Accounting

Malaysia adopts a territorial system of income taxation.

. From a plain reading of section 331 of the ITA the requirements to be satisfied are twofold. Grant or subsidy received from the Federal or State Government are exempted from income tax. Also take director fee no additional tax relief to your company in form of employers KWSP portion.

Expenses of a private or domestic nature are expressly excluded from deduction. Where the director fee first becomes receivable in the relevant period that amount will be deemed to be obtainable on demand in. Tax Deduction for Secretarial and Tax Filing Fee.

Franchise is a business model where franchisee is given the rights to offer sell or distribute products or services based on the systems and marketing plans set by the franchisor. Accrued legal fees tax deductible 15 février 2022 dans beachfront rv park brookings or par dans beachfront rv park brookings or par. The company voted and approved directors fee of 20000 on 30 Jun 2021 to be paid to you for your service rendered for the accounting year ended 31 Dec 2020.

12112011 3147 Franchise fee is now tax deductible in Malaysia announced by Prime Minister Dato Seri Najib in Budget 2012. C Legal fees paid for transfer of land titles sub-division and conversion of land. Where a company has interest expense in excess of 20 of Tax-EBITDA the excess can be carried forward and deducted against the adjusted income of the company for subsequent YAs.

English 中文 BM. Accrual of director fee since 2019 RM150000. Fines and penalties Fines and penalties are generally not deductible.

The tax treatment in respect of the shares offered to the employee free. Get Quotations Now. Taxes Taxes on income are generally not deductible whereas indirect taxes are.

Resident companies are taxed at the rate of 24. Any debt that is due and payable by the company as an employer in relation to tax deductions from emoluments. A company or corporate whether resident or not is assessable on income ACCRUED IN OR DERIVED FROM MALAYSIA.

So first estimate the tax relief you can claim take salary amount that gives lower bracket remainder income take as director fees. C Legal fees and agency fees incurred in connection with employment. Subsection 251 of the ITA the amount that is chargeable to tax for YA 2018 is RM4500 RM450 x 1000.

Any tax that is due and payable by a company. Accrual of director fee since 2020 RM200000. Accrual of director fee since 2018 RM100000.

B Claim for compensation for trading goods destroyed defective or lost in transit. In other word director fee was deemed as received Income on subsequent year even there is no payment yet has been made to director. Income derived from sources outside Malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business.

Directors Remuneration and Tax Planning- Evidence from Malaysia. Given 2 Director of Kena Tax Sdn Bhd never pay the personal tax on the director fee assuming not yet receipt. Your fee will be treated as income for.

Carryforward of interest expense. Payment of fees to directors. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

22019 which explains the liabilities of a company director in respect of the companys tax including. For example the cost of hiring domestic servants to help in housekeeping while one is away at work is not. However subsequent profits arising from the sale of shares on 192018 are capital gains and are not subject to tax.

The deduction is limited to 10 of the aggregate income of that company for a year of assessment. The Rules and Guidelines provide that the maximum amount of deductible interest is 20 of the amount of Tax-EBITDA. Employees are allowed a deduction for any expenditure incurred wholly and exclusively in the performance of their duties but no allowance is given for tax depreciation.

Effective year of assessment 2020 tax deduction allowed up to maximum of RM15000 per year. NEWPAGES - Laman Utama. Before company year end closing account decide how much director fee to take.

Directors fees income received as a non-Malaysian citizen director of a Labuan entity are exempted from income tax until YA 2025. 21 Government grant or subsidy. Prior to year of assessment 2015 directors fees are taxable in the hands of the directors when they are paid.

The board is empowered again subject to the constitution to approve the fees of the directors and benefits payable to them including any loss of employment4 It is a requirement under the Act that such approval be recorded in the minutes of the directors and shareholders. However with Section 294 and 5 enacted into the Income Tax Act effective from year of assessment 2015 the following principle shall apply. THK Management Advisory Sdn Bhd - Johor - Accrued Directors Fees Tax Treatment Malaysia.

Directors fees approved in arrears. Note for Accrued Director Fee 应付董事费的注意 事项 The director is deemed to be able to obtain on demand the receipt of such amount in the basis period immediately following relevant period since 2015. In any given YA.

On 14 March 2019 the Inland Revenue Board of Malaysia issued Public Ruling No. THK Management Advisory Sdn Bhd. 59 Other legal expenses a Renewal of leases and licenses.

20 Non-Malaysian directors fees income from a Labuan entity. The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. Under section 331 of the Income Tax Act 1967 ITA all outgoings and expenses wholly and exclusively incurred during a specified period by the business in the production of gross income from a source is deductible.

Withholding Tax Services In Malaysia Taxation Services Malaysia

Director S Remuneration And Tax Planning Evidence From Malaysia Malaysian Financial Planning Council

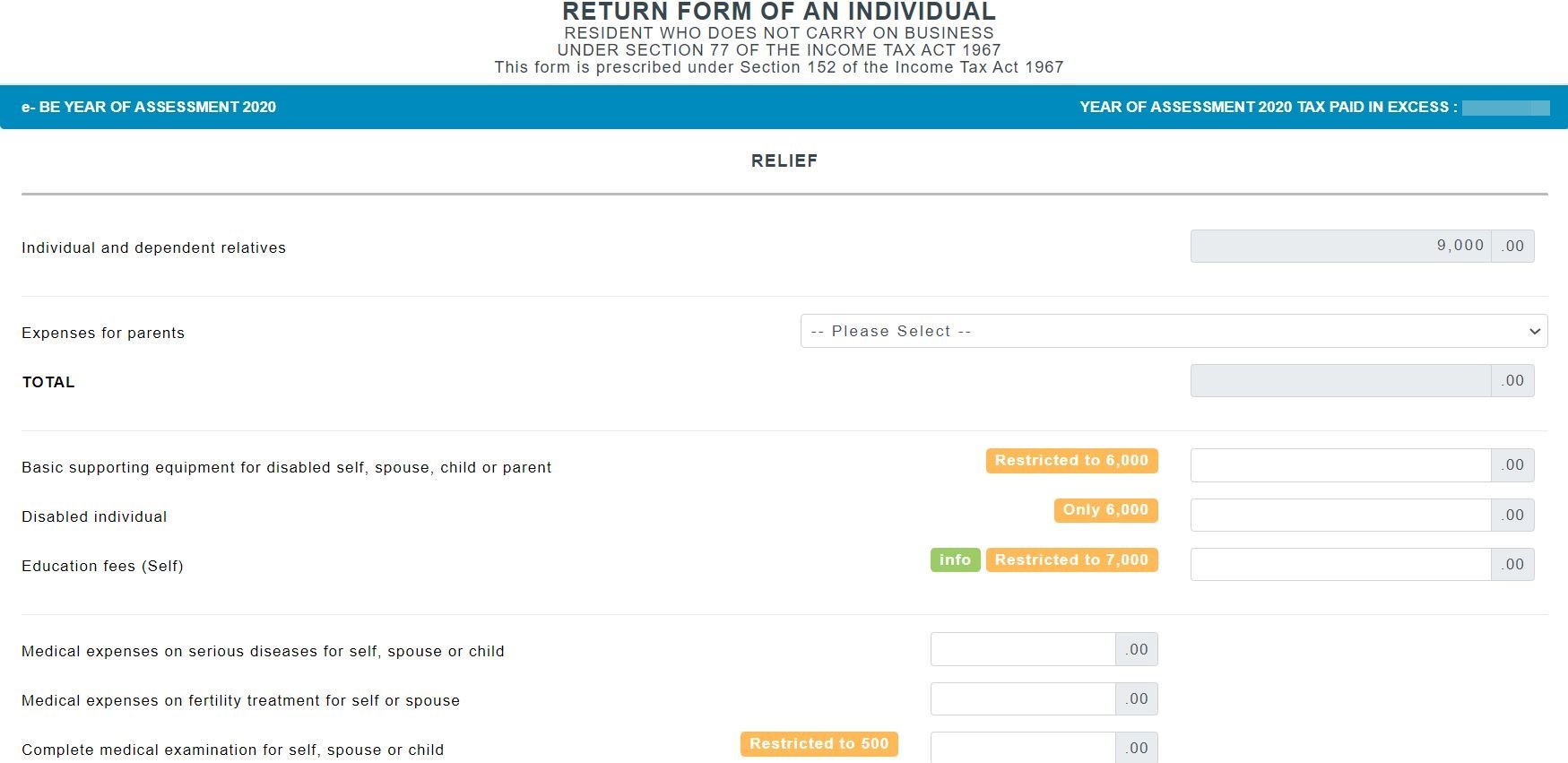

Malaysia Personal Income Tax Guide 2021 Ya 2020

What Is An Investment Holding Company And When Is It Useful

Sample Liquidation Report Excel

China Annual Individual Income Tax Reconciliation Tax Refund Faqs

Director S Remuneration And Tax Planning Evidence From Malaysia Malaysian Financial Planning Council

Withholding Tax Services In Malaysia Taxation Services Malaysia

Hr Reimagines Itself Through The Pandemic Grant Thornton

Malaysia Personal Income Tax Guide 2021 Ya 2020